When Will the Oilfield Crash Again

1980s oil bust left a lasting mark

This is a carousel. Use Next and Previous buttons to navigate

As the 1980s got underway, Houston's oil industry was in the midst of nearly a decade of opulence, supported by record crude prices that followed the Arab oil embargo of 1973 and the Iranian Revolution of 1979.

Sleek company cars plied the streets of the city. Membership at tony golf clubs soared. Corporate jets stood at the ready to whisk executives to anywhere in the world.

RELATED: South Texas tries to turn an oil crash into a soft landing

But just a few years later, it all came crashing down with the price of oil. The jets were grounded, cranes dismantled and commercial projects scrapped. Thousands of workers lost jobs and scores of companies went belly up.

"It wasn't much fun," said Patrick Fairchild, a geologist based in West Texas, whose Midland oil company went bankrupt when struggling lenders called his loan in 1986 - even though he was still making payments.

As Houston struggles through the latest oil bust, the 1980s crash remains the downturn against which all others are measured, an epic collapse that forced the region to confront its dependence on a single industry and begin a long process to diversify its economic base. Students of history can argue about which oil bust hit Houston's energy sector harder, but there's little debate that the 1980s collapse did far more damage to the local economy.

The colossal fall in oil prices that began in 1982 and accelerated in 1986 not only sapped Houston's wildcatter spirit, but undermined Houston's economic foundations. Houston lost more than 225,000 jobs, about one in eight, and unemployment rate climbed above 9 percent - nearly double today's rate. Office vacancies soared above 20 percent. Office rents plunged.

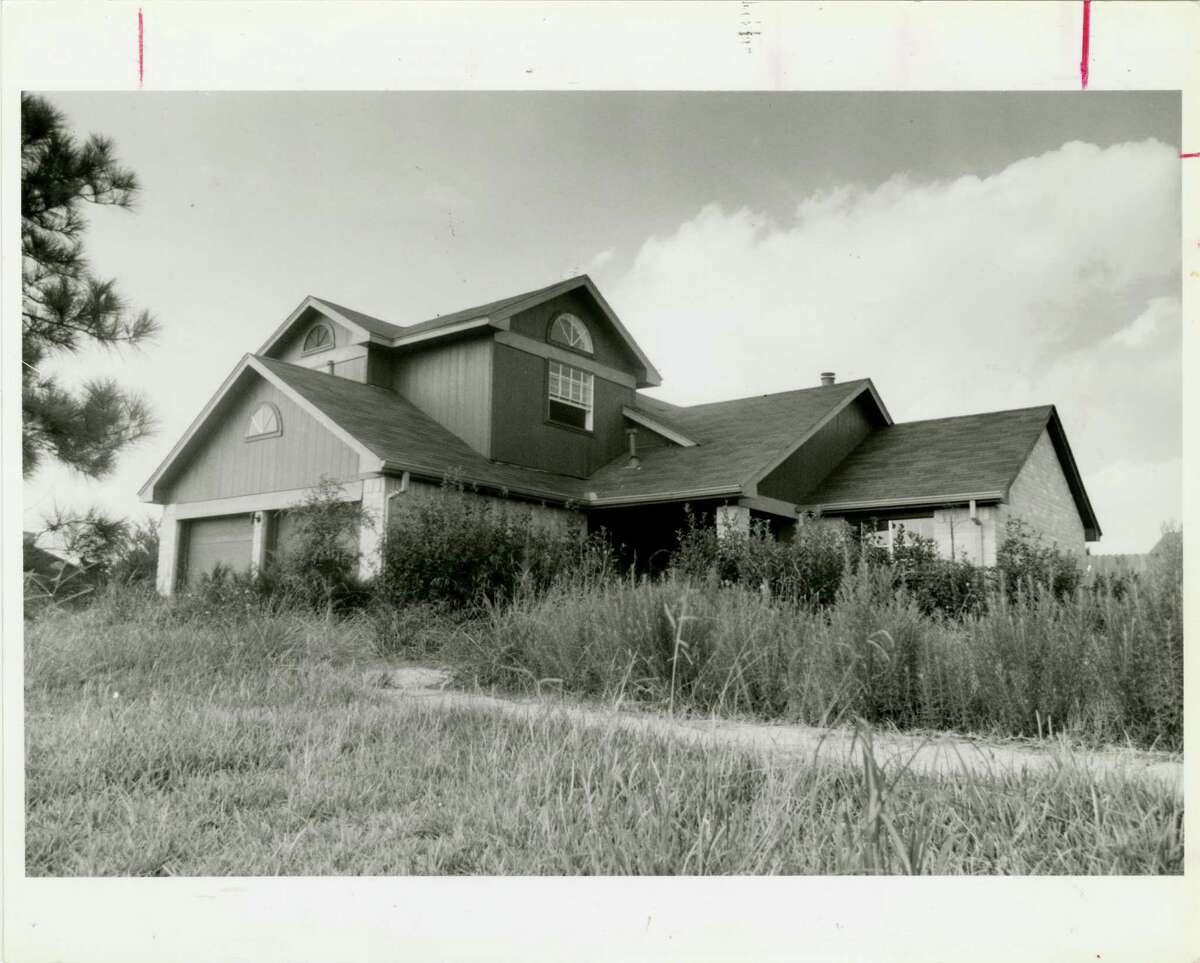

Loan payments to banks soon followed. Risky commercial real estate and energy loans went bad and hundreds of banks failed. Construction ground to a halt. More than 200,000 homes stood vacant.

"I remember seeing apartment projects started and not completed, new office buildings just sitting vacant, residential areas where streets got put in but never completed," said Keith Miller, senior energy lender at Mutual of Omaha Bank. "It was a low time for the Houston economy."

MORE HISTORY: Shell Oil helped ignite the growth of Houston's downtown skyline

After the shock of the 1973 Arab oil embargo, crude prices stayed high as the newly formed Organization of Petroleum Exporting Countries controlled production to keep supplies tight. Imported oil prices averaged at a peak $39 a barrel - or more than $106 in 2016 dollars - in the summer of 1981, according to the Energy Information Administration.

But prices began falling in March 1982 amid a decline in oil demand as the United States limped through a recession and Europe and other nations slowed economically, in part because of expensive fuel prices. From January to June 1986, crude prices fell 52 percent, or to about $27 a barrel in 2016 dollars. The price drop accelerated as Saudi Arabia pushed its crude production higher.

The nation's rig count fell from a peak of more than 4,500 in late 1981 to a low of 663 in July 1986. Sales of oil field equipment plunged from $40 billion to $9 billion over the same period, according to the Federal Reserve Bank of Dallas.

Drilling rigs were torn apart and sold for scrap, at pennies on the dollar. For people trying to figure out how much the machines were worth, the first question wasn't "How much oil can it drill up?" It was "How much does it weigh?"

Attendance plummeted at the Offshore Technology Conference, one of the energy industry's biggest events. More than 100,000 people had packed the trade show in 1982; two years later, organizers had the conference without an exhibition because so few people would attend. By 1987, OTC attendance reached only 25,000, just one-fourth of what it was five years earlier.

A Wall Street Journal article claimed the most exotic dish served at one Houston dinner party was a plate of cheese balls. The New York Times wrote about a Houston dentist who reported an increase in teeth-grinding problems among the locals.

In the boom years, "you got a free car and all the gas you could put in it," said Mark Parrish, who worked for an independent oil company in the 1980s. "That was the first thing that went away. It was a pretty big hit."

Bigger hits followed. In oil towns like Midland, laid-off oil workers lived in tents, recalled Fairchild, the geologist. One lived in the cardboard box his refrigerator had come in.

October 1973

The Arab oil embargo leads to rising energy prices and mile-long lines at gasoline stations in the United States.

December 1973

The U.S. rig count stands at more than 1,200.

December 1981

The U.S. rig count reaches 4,500 even though oil demand declines after large consumer markets such as the United States and Canada slip into recession.

March 1982

The beginning of the bust. Demand sinks below daily oil production and crude prices start falling.

January 1986

The decline in oil prices accelerates, and U.S. crude prices fall by half in just a few months. Baker International and Hughes Tools, two oil field service companies, merge to ride out the downturn.

1987

Harris County has 30,000 home foreclosures.

1989

The worst of the bust is over after more than 225,000 workers lose jobs and 130 Texas banks fail.

Source: Federal Reserve Bank of Dallas

"Houses were just being evacuated," Fairchild said. "It was a crazy time."

In many ways, the oil industry felt the repercussions of this epic oil bust for years. A generation of young petroleum engineers, for example, left the industry and never returned, leaving oil companies to grapple with a middle-age talent gap that persisted even into the recent oil boom.

The searing experience also provided a lesson that political, business and civic leaders took to heart: The region's economy could not depend so heavily on one industry. Efforts to diversify the local economy got underway, and today, sectors like the large and growing health care industry are tempering the impact of the latest oil bust.

RELATED: Houstonians fairly upbeat despite oil price crash

Banking in the region has changed, as well. The arrival of interstate banking in 1987 allowed out-of-state institutions to snap up troubled Houston banks, and helped stabilize the local financial system. Most of the region's banking is done by large national lenders, rather than scattered, small independent banks, providing greater access to credit and capital.

The oil and gas industry has again been battered, this time by a slide in prices that began in the summer of 2014. More than 170 North American oil producers and oil field services companies, many in Texas, have gone bankrupt, according to Dallas law firm Haynes & Boone. Tens of thousands of oil and gas jobs have been lost. Many companies continue to struggle under the weight of some $500 billion in high-interest debt that independent firms ran up during the latest boom.

The broader economy, so far, has held up much better than 30 years ago. The Houston area is still adding jobs, albeit barely. The real estate market is cooling, but not collapsing. Sectors such as health care and petrochemicals are still growing.

In an interview in 1989, the University of Houston economist Barton Smith said the oil boom of the 1970s and early '80s caught the city by surprise, and it perhaps grew too far, too fast, which intensified the bust.

"But we've learned a lesson," he told the Houston Chronicle. "All we need to do is remember it."

Source: https://www.chron.com/local/history/economy-business/article/The-1980s-oil-bust-left-lasting-mark-on-Houston-9195222.php

0 Response to "When Will the Oilfield Crash Again"

Post a Comment